How Buying or Selling a Home Helps Your Local Economy

Whether you’re buying or selling a house, here’s something to think about that most people don’t. Your decision doesn’t just impact your life and your family’s, it sparks a ripple effect that has a positive impact on your entire community.

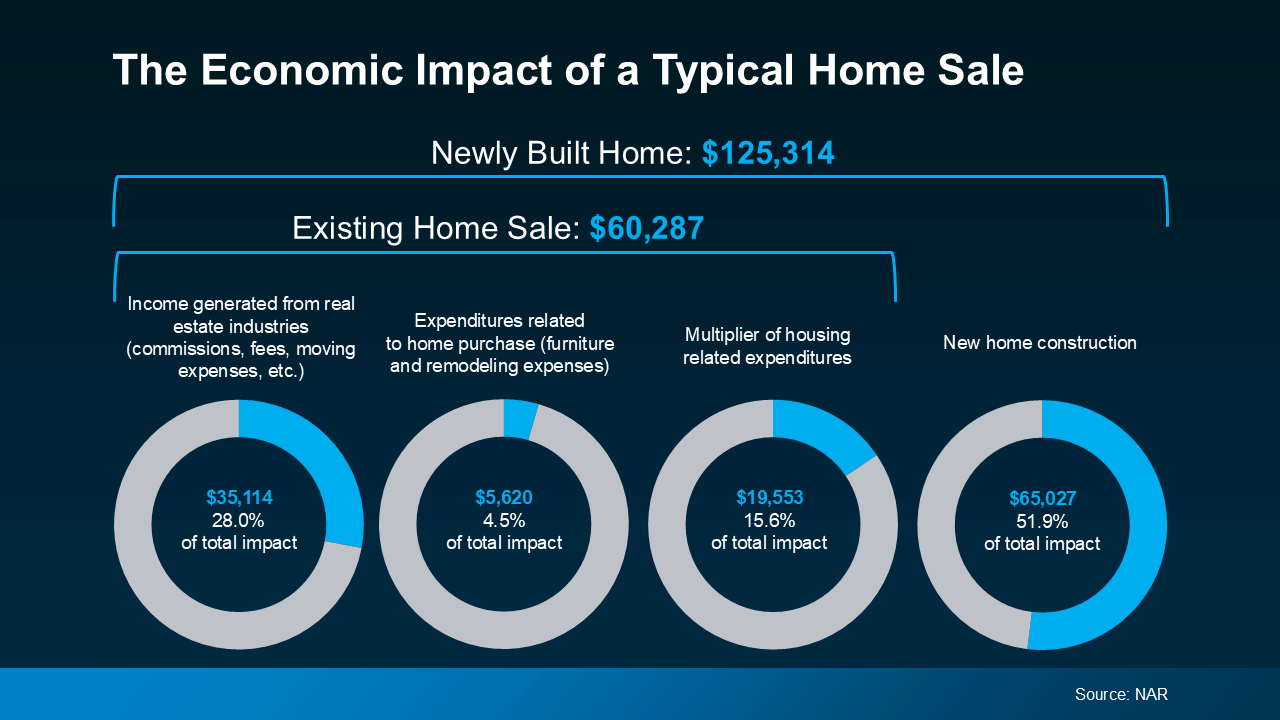

Every year, the National Association of Realtors (NAR) puts out a report that breaks down the financial impact that comes from people buying and selling homes.

The data shows that if you buy an existing (previously lived-in) home, you're giving the local economy a boost of just over $60K. And if you buy a newly built home, that number goes up to over $125K (see visual below):

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

“. . . housing is a significant job creator. In fact, for every single-family home built, enough economic activity is generated to sustain three full-time jobs for a year . . .”

When you think about it, it makes sense. Behind every home sale is a network of people involved, including contractors, city officials, real estate agents, lawyers, specialists, and more. Everyone has a job to do to help make sure your deal goes through.

Put simply, when you buy or sell a home, you’re helping out your neighbors. So, your decision to move doesn’t just meet your needs; it supports their families, strengthens your town, and shapes the future of your community.

Imagine walking through the front door of your next home, knowing your decision helped a local contractor keep their crew working or a small business thrive. Remember that feeling as you make your decision this year.

Bottom Line

Moving isn’t just a personal milestone – it's an investment in your community, too. If you’re ready to make a move, let’s connect. You’ll make a difference for more people than you know.

What’s most important to you as you prepare to buy or sell your house this year?

OFFICE

6085 Douglas Blvd #300

Granite Bay, CA 95746

All Rights Reserved | Jay Friedman Realty Team | Privacy Policy

DRE # 01468010

Real Estate Web Design by Bullsai