Now’s a Great Time To Sell Your House

Thinking about selling your house in Granite Bay, Loomis, Roseville, Rocklin, Folsom, or anywhere in the Sacramento valley? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move.

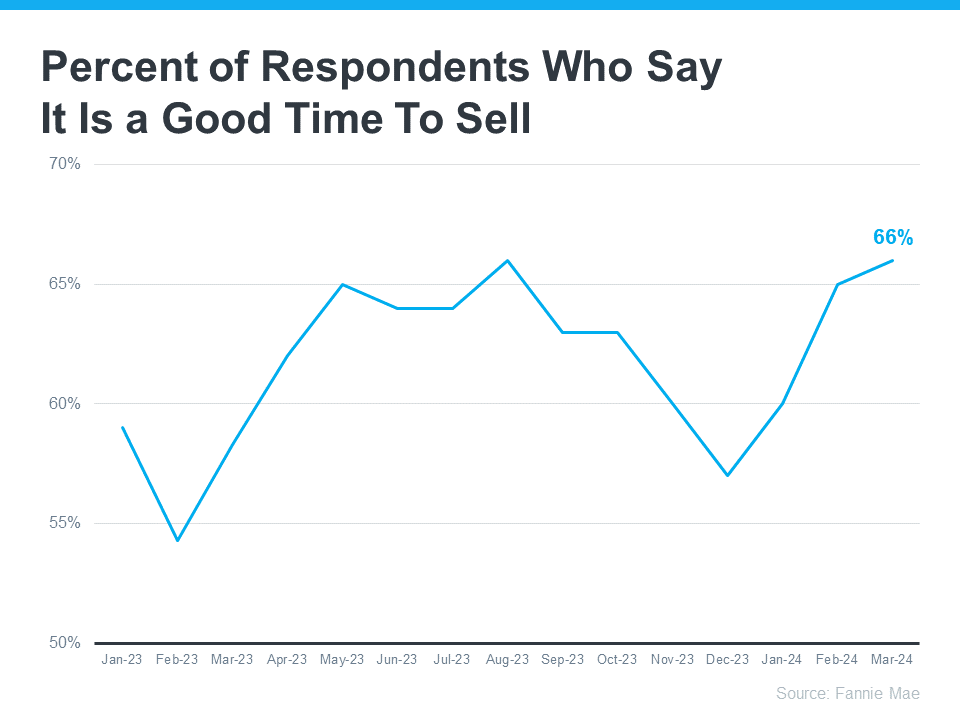

Here’s something else to consider. According to the latest Home Purchase Sentiment Index (HPSI) from Fannie Mae, the percent of respondents who say it’s a good time to sell is on the rise (see graph below):

Two of the top reasons had to do with aging parents. 27% of buyers chose multi-generational homes so they could take care of their parents more easily. And 19% did it to spend more time with them. A lot of older adults want to age in place, and living in a home with loved ones can help them do just that. If your parents are hoping to do the same, but need a bit of help, a multi-generational home may be worth considering.

But buying a multi-generational home isn’t just about being close or taking care of the people you love—it can save you money, too. 22% of buyers say they picked a multi-generational home to cut down on costs, and 11% needed a bigger house multiple incomes could afford together.

Sharing costs like the mortgage and utilities can make owning a home more affordable. This is especially helpful for first-time homebuyers who might find it challenging to buy a place on their own in today's market.

As Axios explains:

“Financial concerns and caregiving needs are two of the major reasons people live with their parents (and parents’ parents).”

How an Agent Is Key in Finding the Right Home for You

Looking for the perfect multi-generational home is a bit trickier than finding a regular house. You've got more people, which means more opinions and needs to think about what house is right and why. It's kind of like putting together a puzzle where all the pieces need to fit perfectly.

If you're into the idea of living with loved ones and want all the benefits that come with it, team up with me so that I can help you out.

Bottom Line

Whether you're looking to save money or want to take care of your loved ones, buying a multi-generational home might be a good idea for you. If you want to find out more, let’s talk.

OFFICE

6085 Douglas Blvd #300

Granite Bay, CA 95746

All Rights Reserved | Jay Friedman Realty Team | Privacy Policy

DRE # 01468010

Real Estate Web Design by Bullsai