What’s Really Happening with Mortgage Rates?

Are you feeling a bit unsure about what’s really happening with mortgage rates? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true.

The simplest answer is: that what you read or hear will vary based on the time frame they’re looking at. Here’s some information that can help clear up the confusion.

Mortgage Rates Are Volatile by Nature

Mortgage rates don’t move in a straight line. There are too many factors at play for that to happen. Instead, rates bounce around because they’re impacted by things like economic conditions, decisions from the Federal Reserve, and so much more. That means they might be up one day and down the next depending on what’s going on in the economy and the world as a whole.

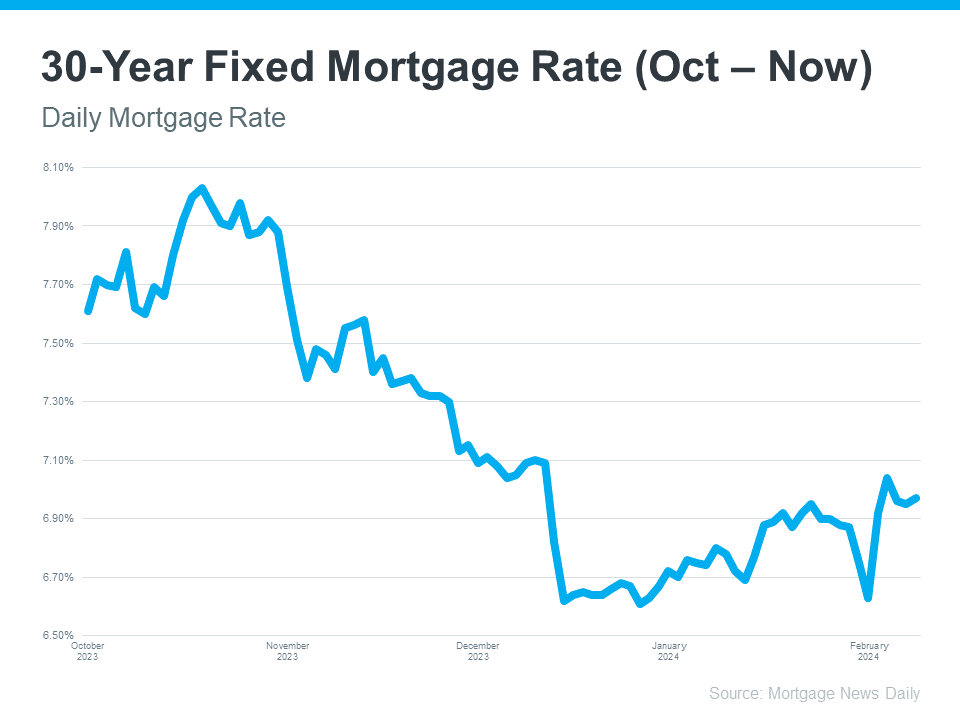

Take a look at the graph below. It uses data from Mortgage News Daily to show the ebbs and flows in the 30-year fixed mortgage rate since last October:

If you look at the graph, you’ll see a lot of peaks and valleys – some bigger than others. And when you use data like this to explain what’s happening, the story can be different based on which two points in the graph you’re comparing.

For example, if you’re only looking at the beginning of this month through now, you may think mortgage rates are on the way back up. But, if you look at the latest data point and compare it to the peak in October, rates have trended down. So, what’s the right way to look at it?

The Big Picture

Mortgage rates are always going to bounce around. It’s just how they work. So, you shouldn’t focus too much on the small, daily changes. Instead, to really understand the overall trend, zoom out and look at the big picture.

When you look at the highest point (October) compared to where rates are now, you can see they’ve come down compared to last year. And if you’re looking to buy or sell a home, this is big news! The lower the rates, the higher the affordability and the more buyers can afford to buy. The more buyers there are qualified, then the more competition, and possibly more offers on the existing houses for sale. Don’t let the little blips distract you. The experts agree, overall, that the larger downward trend could continue this year.

The Details

2023 was the least amount of homes sales since 1993. In 1993 the population in the United States was 260 Million People. In 2023 the population was 340 Million People. What this means to us who are in Real Estate is there are millions off people sitting on the side lines awaiting for affordability to become a bit better so they can stop throwing away money on rent and start buying sa home.

Last year there was 3.9 million homes sold. In 2022 there were 5.03 million sales, and they project that in 2024 we will be back up to 4.6 Million home sales, reaching 5.3 million sales in 2025. It is a slow correction, but the sales are coming on strong and the buyers are coming back into the marketplace as affordability of the rates have come down.

OFFICE

6085 Douglas Blvd #300

Granite Bay, CA 95746

All Rights Reserved | Jay Friedman Realty Team | Privacy Policy

DRE # 01468010

Real Estate Web Design by Bullsai