Why Your House Will Shine in Today’s Market

Even though interest rates are lower than last year, the rates are still keeping buyers from buying a house unless they really like it a lot. There are more homes available for sale than there were at this time last year, there are more buyers than there are good houses to to keep up with the demand. So, know that if you’ve got moving on your mind, your house needs to be prepped and really stand out to make a buyer say “I want to buy it!”

There are several key reasons why there aren’t enough homes to go around and understanding them will help you see why the market is working in your favor if you’re ready to make a move.

What’s Causing the Shortage?

1. Underproduction of Homes: For years, the industry hasn’t built enough homes to keep up with demand. As Zillow explains:

“In 2022, 1.4 million homes were built — at the time, the best year for home construction since the early stages of the Great Recession. However, the number of U.S. families increased by 1.8 million that year, meaning the country did not even build enough to make a place for the new families, let alone begin chipping away at the deficit that has hampered housing affordability for more than a decade .”

2. Rising Costs: Building materials, labor shortages, and supply chain disruptions caused by the pandemic have all made it harder and more expensive to build homes. This can either limit or stop new home construction in some areas.

3. Regional Imbalances: Some markets are more affected by the shortage of homes than others. Popular and more desirable areas have more people moving in faster than new homes can be built. The number of new building permits issued doesn’t always keep pace with job growth in these regions, and that leads to even tighter markets and higher prices.

How Big Is the Problem?

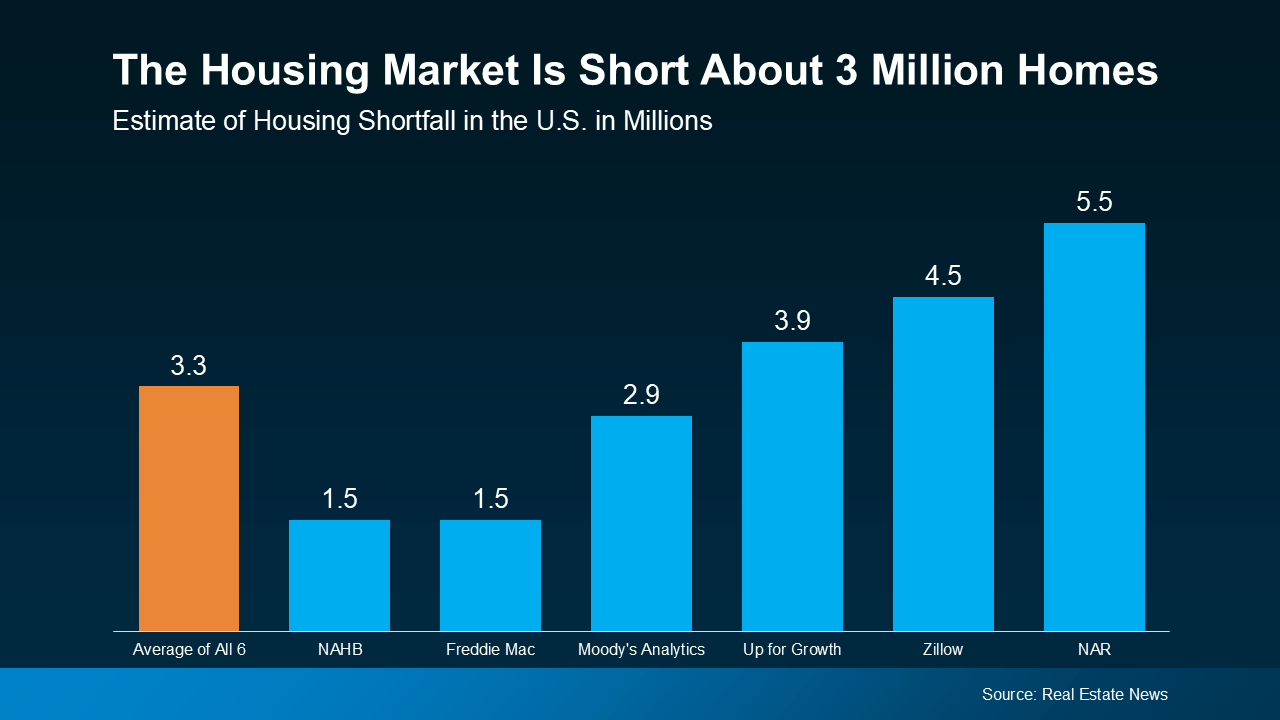

According to estimates from Real Estate News, the U.S. is facing a housing shortfall of roughly 3.3 million homes, based on an average of several expert insights (see graph below):

This shows there’s a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

According to John Burns Research and Consulting (JBREC), over the next 10 years, the U.S. will need about 18 million new homes to meet projected demand, including homes for new households, second homes, and replacements for aging or unusable homes.

So, even though more homes are on the market compared to last year, there still aren’t enough of them to go around. This is where you can really win if you’re ready to sell your house.

What You Need To Remember

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers. It’ll take years to climb out of this inventory deficit, and the market is still very tight. So, when buyers are competing for relatively few homes like they are right now, that creates more interest in the houses that are on the market, putting upward pressure on prices and ultimately working in your favor.

And since every market is different, it’s important to work with a real estate agent who understands local trends. They can help you price your house right and create a strategy to attract the right buyers.

Bottom Line

While there are more homes for sale than there were at this time last year, the buyers are still picky and need to fall in love with the house to want to make it home. This puts you in the driver’s seat as a seller, but don’t get too demanding as the buyers will not over pay. We need to price your house appropriately to get it sold. Let’s connect so you have someone who can help you take advantage of today’s market.